Overview

The Algorithmic Trading Platform is a sophisticated system that enables traders to build, backtest, and deploy complex trading strategies across multiple assets. Built with FastAPI and Next.js, it features an intuitive drag-and-drop interface for strategy creation, comprehensive backtesting capabilities, and real-time market data integration. The platform connects to brokerage accounts like Charles Schwab and uses Polygon.io for streaming market data, making it a powerful tool for both retail and professional traders.

Goals and Motivation

Algorithmic trading presents significant challenges for individual traders and smaller firms who need to:

- Create complex strategies with minimal coding

- Test strategies against historical data

- Monitor performance across multiple assets

- Execute trades automatically based on predefined rules

- Manage risk with sophisticated controls

While professional trading platforms exist, they often lack flexibility or require extensive programming knowledge. This platform bridges this gap by providing an intuitive interface for developing intricate trading strategies while maintaining professional-grade performance and reliability.

Technology Stack

FastAPI & Python

Powers the robust backend with an emphasis on performance and reliability:

- Pydantic Models: Ensures data validation and clean API contracts

- Async Database Operations: Handles high-throughput data operations

- WebSockets: Enables real-time market data streaming

Next.js & React Flow

Delivers a responsive and intuitive frontend experience:

- React Flow: Implements the drag-and-drop strategy builder

- shadcn/ui & Tailwind: Provides clean, consistent styling

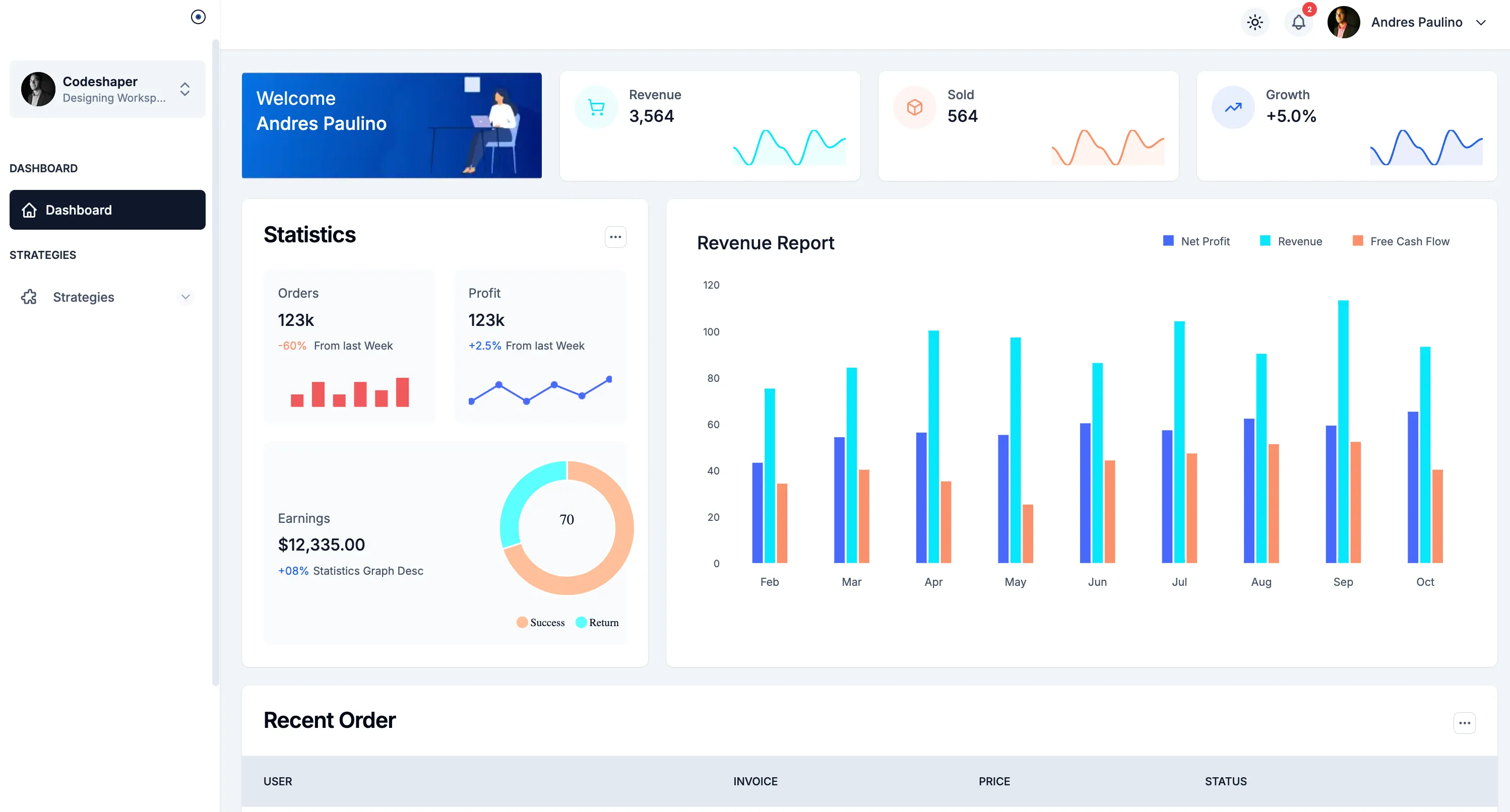

- Real-time Charts: Visualizes strategy performance and market data

PostgreSQL with JSONB

Implements a flexible yet powerful database design:

- JSONB Columns: Stores complex strategy configurations

- Time-Series Optimization: Efficiently handles market data

- Proper Indexing: Ensures high-performance queries

Key Features

Dashboard

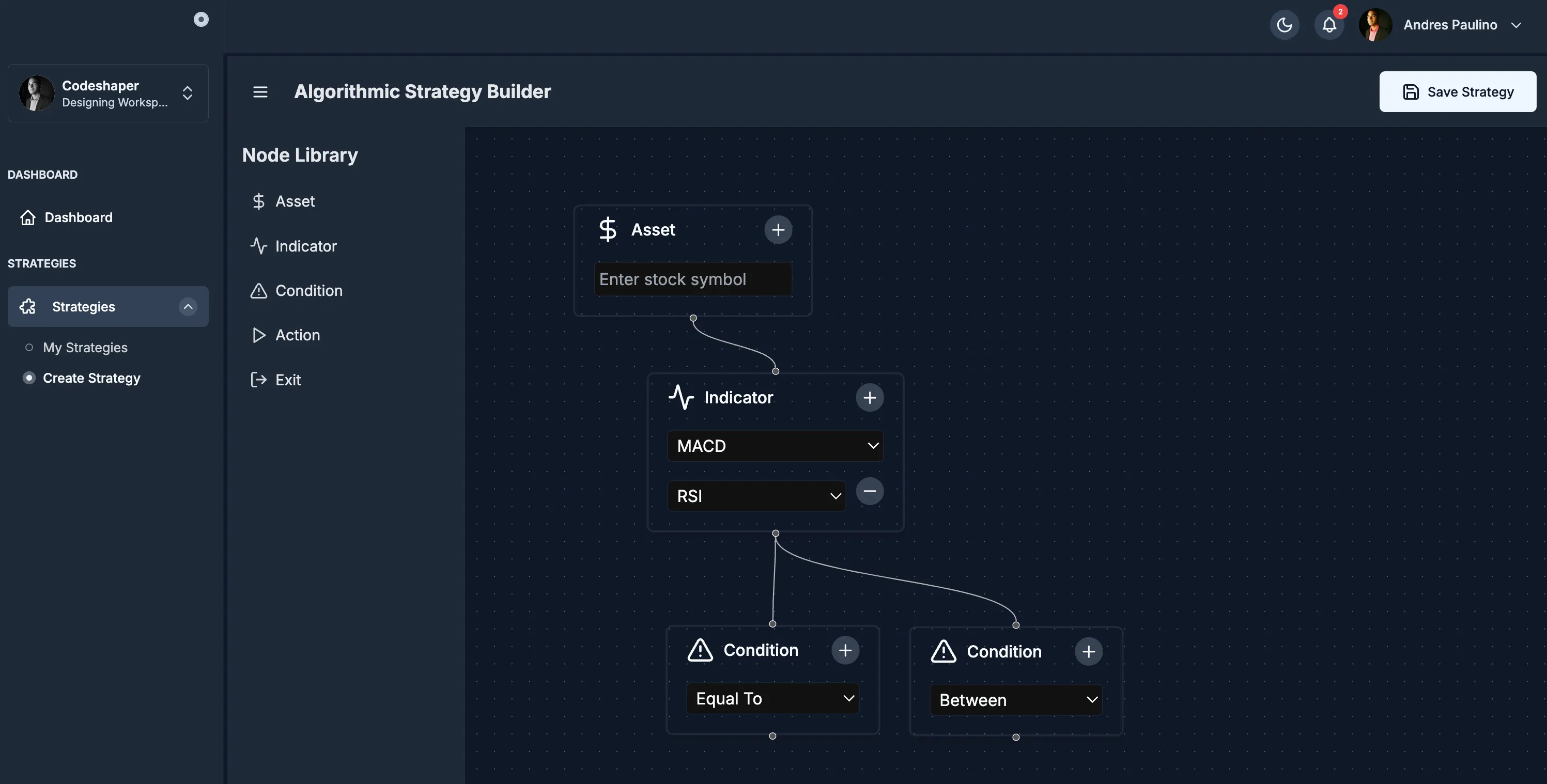

Drag-and-Drop Strategy Builder

Create sophisticated trading strategies without writing code. The visual builder supports:

- Technical indicator combinations

- Multi-condition entry and exit rules

- Time-based filters

- Risk management parameters

- Custom indicator definitions

Multi-Asset Support

Apply strategies across multiple trading instruments:

- Symbol-based filtering

- Sector and market cap selection

- Custom watchlists

- Correlation-based filtering

- Portfolio-wide risk management

Comprehensive Backtesting

Test strategies against historical data with detailed analytics:

- Customizable date ranges

- Performance metrics calculation

- Entry/exit visualization

- Drawdown analysis

- Sharpe ratio and other risk metrics

Real-Time Trading

Execute strategies with live market data:

- Brokerage integration (Charles Schwab)

- Real-time data streaming via Polygon.io

- Automated order execution

- Position monitoring

- Trade logging and analytics

Challenges and Solutions

Strategy Representation

Representing complex trading strategies in a flexible database schema presented challenges:

- Balancing flexibility with query performance

- Supporting diverse strategy types

- Enabling strategy versioning

We solved this by implementing:

- JSONB columns for dynamic strategy components

- Structured metadata for efficient filtering

- Component-based strategy architecture

Real-Time Data Processing

Handling high-frequency market data required careful system design:

- Efficient WebSocket connection management

- Selective data subscription

- Strategy evaluation optimization

Our solution involved:

- Asynchronous processing pipelines

- Strategic data caching

- Selective indicator calculation

Trade Execution Reliability

Ensuring reliable trade execution presented critical challenges:

- Managing API rate limits

- Handling partial fills and rejections

- Maintaining state during disconnections

We addressed these by:

- Implementing a robust state machine for orders

- Creating retry mechanisms with exponential backoff

- Building comprehensive logging and alerting

Future Enhancements

Machine Learning Integration

Planning to add AI-powered features:

- Strategy optimization suggestions

- Anomaly detection in market data

- Predictive performance modeling

- Parameter optimization

Enhanced Risk Management

Expanding risk control capabilities:

- Portfolio-level risk metrics

- Automatic stop adjustment

- Volatility-based position sizing

- Correlation-based exposure management

Social Trading

Building collaborative features:

- Strategy marketplace

- Performance leaderboards

- Strategy sharing and forking

- Community feedback and ratings

Lessons Learned

This project provided valuable insights into:

- Financial data streaming architecture

- State management in trading systems

- Strategy representation and evaluation

- WebSocket performance optimization

The most important takeaway was balancing flexibility with performance. Trading strategies need to be both expressive enough to capture complex ideas and efficient enough to execute in real-time market conditions.

Last updated on February 25, 2025 at 7:35 AM UTC+7. See Changelog